Gross Income Calculator Australia

Salary Before Tax your total earnings before any taxes have been deducted. Calculate salary after taxes.

Taxable Income Formula Examples How To Calculate Taxable Income

This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions.

Gross income calculator australia. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week. The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015-2016 tax year to the most recent tax year 2020-2021. Information you need for this calculator.

The Tax Assessment Calculator allows you to calculate what tax is payable on your Gross Annual Income on a per annum bases. Simply select the appropriate tax year you wish to include from the Pay Calculator menu when entering in your income. What your take home salary will be when tax and the Medicare levy are removed.

The Annual salary calculator for Australia. Enter your Annual salary and click calculate. Also known as Gross Income.

Values less than or equal to 1000 will be considered hourly. To use this Tax Calculator you need to input your Gross Annual Income or Salary. Income tax on your Gross earnings Medicare Levy only if you are using medicare Superannuation paid by your employer standard rate is 95 of your gross earnings.

Youll see your annual gross income annual tax payable your tax to gross income ratio and a handy visual chart indicating the ratio. This Calculator will display. Total amount of deductions to claim.

You can personalise this tax illustration by choosing advanced and altering the setting as required. How much Australian income tax you should be paying. Which tax rates apply.

This calculator now conforms to the Australian Tax Offices Pay As You Go PAYG schedules. This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly. It can be used for the 201314 to 202021 income years.

Gross Income Calculator More Calculators Rent vs Buy Calculator. The Australian salary calculator for 202122 Annual Tax Calculations. Total amount of tax that was withheld.

The latest PAYG rates are available from the ATO website in weekly fortnightly and monthly tax tables. It can be used for the 201314 to 202021 income years. Simply enter your annual or monthly income into the tax calculator above to find out how Australian taxes affect your income.

If you have HELPHECS debt you can calculate debt repayments. Consider the leusderheide schietbaan Pros and gross net income calculator australia Cons of Expensing Stock Options. Below is the table what you could get back based on your pay Updated for 20182019 it accurately calculates your HMRC Income Tax NOTE.

Gross and Net Calculator. This calculator can also be used as an Australian tax return calculator. Simply enter your Gross Income and select earning period.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Calculate the estimated stamp duty amount you would need to pay to purchase the property. Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22 Budget.

Youll then get a breakdown of your total tax liability and take-home pay. 60 000 dollars a year is how much every two weeks. Net to Gross Income - Rise High.

This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. Your residency status for taxation purposes.

Total gross income payments you received. Youll also see the Tax Threshold button where you can check. Use this calculator to find out if you should continue to rent or its time buy a home.

Before you use the calculator. After changing the advanced tax calculator setting click on calculate to recalculate your tax deductions based on the latest Australian. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

For more information see assumptions and further information. Details of your tax credits and any tax offsets you are entitled to claim. It also provides you with your Net yearly monthly fortnightly and weekly salary.

With the Income gross-up calculator you can put in your annual netafter tax income select whether or not you pay the 2 Medicare levy and voila. Your marginal tax rate.

How To Calculate Income Tax In Excel

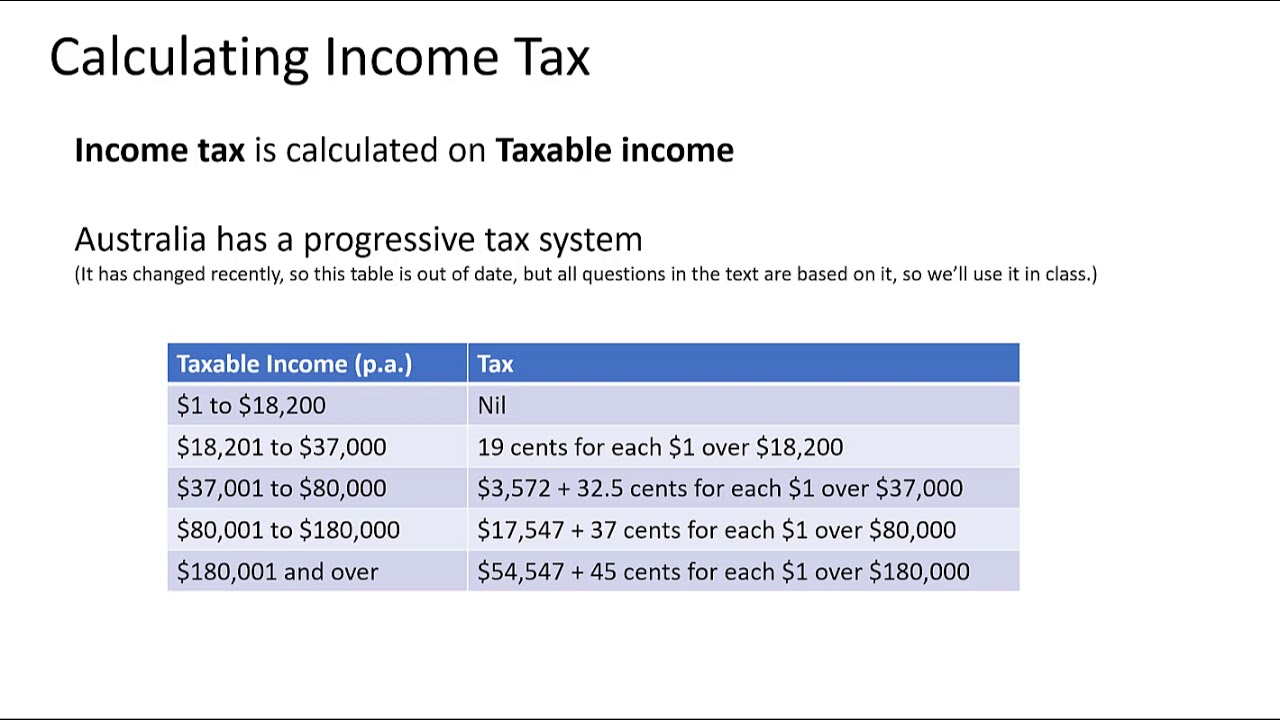

Income Tax Australian Tax Brackets And Rates 2020 21

Income Gross Up Calculator Peard

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

Australia 125000 Salary After Tax Australia Tax Calcu

Taxable Income Formula Examples How To Calculate Taxable Income

Ytd Calculator And What Is Year To Date Income Calculator

Taxable Income Formula Examples How To Calculate Taxable Income

Australian Age Pension Calculator For Download

Taxable Income Formula Examples How To Calculate Taxable Income

How To Create An Income Tax Calculator In Excel Youtube

Taxable Income Formula Calculator Examples With Excel Template

Example Case Study 2 Australian Taxation Office

Prelim Standard Math Calculating Tax Art Of Smart

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Part 3

How To Calculate The Tax In Australia Quora

Au Income Tax Calculator July 2021 Incomeaftertax Com

Post a Comment for "Gross Income Calculator Australia"